Singapore’s Transition to a Low-Carbon Economy

Carbon emissions have risen sharply over the past century due to human activities like burning fossil fuels for energy and transportation. As the impacts of climate change intensify across the globe, countries are working hard to transition to greener economies and bring emissions down to sustainable levels. Singapore, though a small city-state, is no exception. The country understands the need to reduce its environmental footprint and has introduced several bold initiatives to become more climate-friendly. One key initiative that promises to play a big role in Singapore’s transition is its carbon credit scheme.

Carbon Markets and the Singapore Carbon Pricing Act

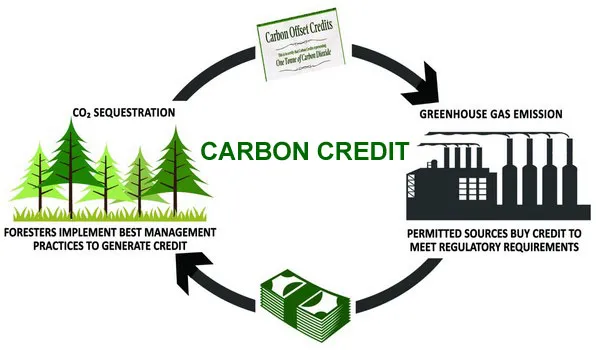

Understanding the need to curb its emissions, back in 2018, Singapore passed the Singapore Carbone Credit Act which laid the foundation for implementing an economy-wide carbon tax and a domestic emissions trading scheme (ETS). The carbon tax, which kicked in from 2019, places a charge on emissions from large direct emitters. The ETS, scheduled to commence in 2023, will allow companies to trade carbon credits allocated to them according to a fixed emissions cap set by the government. Companies can buy credits from other entities if they exceed their quota or sell unused credits if they pollute less than permitted. This market-based mechanism gives participants the flexibility to determine their own path to reduce emissions in the most cost-effective way.

Singapore’s carbon pricing scheme has been hailed as an important first step towards climate action. By putting a monetary value on carbon, it aims to drive the transition to cleaner technologies, encourage energy efficiency and conservation. The revenue collected from the carbon tax will be channelled back to supporting the transition to greener growth through investments in areas like clean energy R&D, infrastructure, skills and capacity building. The ETS further strengthens the scheme by establishing a defined emissions cap while allowing trading of carbon credits within the market. This gives rise to a competitive carbon credit market in Singapore which could play a significant role not just domestically but regionally as well.

Managing the Supply and Demand of Carbon Credits

For any emissions trading scheme to be effective, managing the supply and demand of carbon credits is critical. In Singapore, the Energy Market Authority (EMA) has been designated as the competent authority to oversee the market operations of the emissions trading scheme. The EMA will determine the total quantity of credits or emissions allowance to be issued each year based on the emissions cap and will allocate free credits to covered facilities depending on their sectors and emission intensities. It will also monitor credits transactions as credits change hands within the market.

On the supply side, the EMA will progressively lower the quantity of credits issued each year to ensure Singapore remains on track with its emissions reduction commitments. Additional credits may be generated via approved offset projects that reduce or remove carbon from the atmosphere. On the demand side, covered facilities will need to hold sufficient credits corresponding to their annual emissions by the compliance deadline each year. Facilities can purchase credits from others if they don’t have adequate allowances or banking credits from previous years. The EMA will enforce penalties on entities that fail to surrender sufficient credits. With the role of determining credit allocations, enforcing rule compliance and managing the supply-demand dynamic, EMA essentially regulates the carbon in Singapore.

Potential as a Regional Carbon Trading Hub

The Singapore Carbone Credit shows great potential to emerge as a leading regional trading platform. With its well-established position as a financial hub and transparent regulatory framework, Singapore is well positioned to tap on the growing demand for carbon credits and offsets in the region. Several countries in Southeast Asia like Thailand, Vietnam and Indonesia already have or plan to launch their own carbon pricing policies. As their carbon markets develop, there will likely be opportunities for cross-border trading of credits between these jurisdictions. Singapore’s market could facilitate such trades by providing the necessary market infrastructure, financing options and ensuring quality control of credits.

Furthermore, Singapore could attract investments into high-quality international carbon credits and offsets generated from projects in other developing countries under mechanisms like the Clean Development Mechanism and Sustainable Development Mechanism. With the country’s trade links and investor-friendly business environment, Singapore could act as an important channel to mobilize private capital at scale for carbon reduction projects globally. This has the dual benefit of mitigating climate change as well as advancing sustainable development in partner countries. By developing as a regional exchange, the Singapore carbon market promises to significantly amplify its role in achieving emissions reductions beyond national borders.

Growing Importance of Net-Zero Transition

With mounting climate impacts around the world, the urgency for transitioning to net-zero emissions has never been greater. Singapore recently announced plans to achieve net-zero emissions as early as 2050 by ramping up the deployment of renewable energy, greening the transport and building sectors, developing a hydrogen economy among other initiatives. Transitioning to net-zero will be a tall order for the densely-populated city-state with limited land and renewable resources. But with determination and right policies, it aims to do its part in combating climate change.

The carbon will play a critical enabling role in Singapore’s transition journey to net-zero. By putting a price on carbon and facilitating credit trading, it aims to provide the ongoing incentives required for continual deep decarbonization across all major sectors of the economy over the coming decades. With its dynamic credit trading platform, Singapore can also contribute to global net-zero ambitions by supporting high-integrity emissions reductions worldwide. Overall, Singapore’s transition provides a great example of how even small nations can take ambitious climate action through innovative carbon pricing policies and market mechanisms. If well implemented, its carbon market promises to deliver significant co-benefits for both domestic climate change mitigation efforts and the larger global cause.

In summary, Singapore’s carbon credit scheme establishes an important domestic framework to price carbon and introduces flexibility and incentives for polluters to trim emissions cost-effectively over time. Looking ahead, the fast developing carbon market also represents a significant opportunity for Singapore to emerge as a regional trading hub and help catalyze broader climate action across Asia and beyond. With firm resolve and diligent implementation, Singapore is well-placed to realize the full transformational potential of carbon markets in powering its transition to a competitive low-carbon economy as well as contributing meaningfully to global efforts against climate change.

*Note:

1.Source: CoherentMI, Public sources, Desk research

2.We have leveraged AI tools to mine information and compile it