Remicade (infliximab) was the first anti-TNF biologic therapy approved by the FDA for the treatment of several autoimmune diseases including rheumatoid arthritis and Crohn’s disease. As the blockbuster drug loses patent protection, several biosimilar versions are now entering the market, promising to drive down costs while expanding treatment access. Here is an overview of the Remicade biosimilar landscape and what it may mean for patients and the healthcare system.

What are Biosimilars?

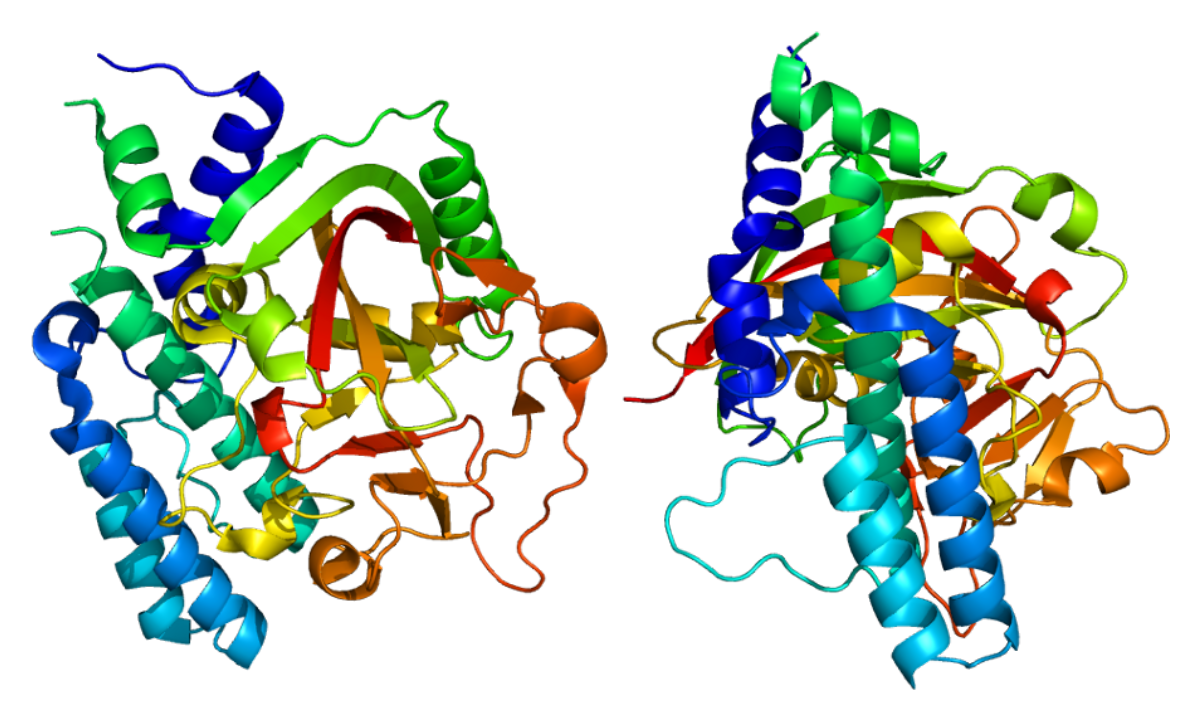

A biosimilar is a biologic medical product that is highly similar to an already approved biologic, known as the reference product. Remicade Biosimilars are developed to have no clinically meaningful differences in terms of safety, purity, and potency from the reference product. While biosimilars are not generic copies, they are proven to be interchangeable with the reference product if approved by the FDA. This allows biosimilars to provide treatment options at a reduced cost compared to the originator biologic.

The First Remicade Biosimilars

Remicade went off-patent in the United States in 2018, opening the door for biosimilar competition. The first Remicade biosimilar, Inflectra (infliximab-dyyb), was approved by the FDA in April 2016, manufactured by Pfizer. Soon after, in July 2016, Celltrion Healthcare received approval for its Remicade biosimilar Renflexis (infliximab-abda). These were the first infliximab biosimilars to gain approval anywhere in the world.

Clinical comparisons showed Remicade biosimilars were highly similar to the reference product in terms of safety and efficacy. Head-to-head trials in ulcerative colitis and rheumatoid arthritis patients found no meaningful differences between Remicade and its biosimilars. Post-marketing studies are ongoing to further establish interchangeability.

Competition Heats Up

In 2020, further competition emerged as other Remicade biosimilars gained FDA approval:

– Ixifi (infliximab-qbtx; Samsung Bioepis): Approved June 2020

– Avsola (infliximab-axxq; Amgen): Approved September 2020

These later approvals paved the way for even more cost savings and treatment access as multiple biosimilar options compete with each other and the reference product. A 2021 study found Ixifi and Avsola led to immediate list price reductions of 30-40% compared to Remicade generics. Competition is expected to drive prices down by 70-80% off the originator drug by 2023.

Growing Demand for Biosimilars

While some physicians were initially hesitant, growing real-world experience is demonstrating biosimilars are safe and effective alternatives to their reference biologics. The Inflammatory Bowel Disease Pandemic Survey reported 94% of patients had a good experience with Remicade biosimilars. The Remicade Access Program saw successful switches in over 60,000 U.S. RA patients with no reported increase in side effects.

Positive clinical evidence and cost savings are increasing acceptance among both providers and payers. A 2021 study showed biosimilar acceptance by rheumatologists jumped from just 42% in 2017 to 91% in 2021. Nearly all health plans now offer treatment options involving Remicade biosimilars, often with preferred formulary placement versus Remicade. As patients realize the benefits of biosimilars, demand will likely continue growing over the coming years.

Biosimilars Expand Treatment Access

While biologics revolutionized care for many chronic diseases, high prices kept some patients from accessing these life-changing therapies. Remicade biosimilars give insurers, hospitals and healthcare systems opportunities to significantly cut drug spending while expanding treatment access.

With projected biosimilar cost savings of up to 80% compared to the originator drug, more public and commercial health plans will be able to cover Remicade biosimilars. This means many patients previously unable to afford treatment may now qualify. Increased availability through the 340B drug discount program also allows safety net clinics to treat underserved groups.

Moreover, biosimilar competition has enabled bundled pay-for-outcomes contracts between health insurers and care providers. For example, one agreement bundles Remicade, infusions and lab monitoring at a flat rate 50% cheaper than before. This kind of outcome-based alternative helps reduce administrative waste while expanding treatment access.

The introduction of Remicade biosimilars has taken the biologics market by storm, bringing unprecedented competition and price reductions to benefit patients and the healthcare system. As clinical experience grows and cost savings are realized, Remicade biosimilars are becoming the preferred treatment option for immune-mediated diseases requiring anti-TNF therapy. Their widespread availability promises to transform patient access and care delivery well into the future.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it