The Emerging Landscape of LNG Bunkering

The Current LNG Bunkering Infrastructure

As the demand for LNG as a marine fuel continues to grow rapidly, ports and terminals around the world have been working to develop the infrastructure needed to service LNG-fuelled vessels. Currently, there are over 20 ports that offer some form of LNG bunkering, with several larger ports and terminals leading the way in capacity. Rotterdam in the Netherlands has established itself as a major LNG bunkering hub, operating truck-to-ship bunkering since 2017 and commissioning an onboard storage bunkering facility in 2021. Other European ports like Gothenburg, Zeebrugge and Antwerp also offer regular LNG bunkering via truck. Beyond Europe, ports in North America and Asia have also invested heavily in developing their LNG bunkering capabilities. Sabine Pass in the US has liquefaction facilities that produce LNG for domestic use and export, while also offering bunkering to ships. In Asia, ports like Singapore, Kobe and Shanghai all have started LNG bunkering operations using truck-to-ship methods.

However, most current LNG bunkering relies on truck-to-ship operations, which present limitations in terms of quantities that can be supplied and safety risks associated with road transportation. There is growing recognition within the marine fuel sector that developing shore-to-ship infrastructure via pipelines, bunker vessels and terminals will be necessary to meet rising demand for LNG bunkering as more ships convert to run on the fuel. Establishing such mid-stream infrastructure is a major challenge that will require coordination between numerous stakeholders and long lead times for planning and construction. But momentum is clearly building as ports, energy companies and shipowners commit more resources towards expanding LNG bunkering infrastructure through larger-scale solutions.

New Projects Bring Increased Scale and Capacity

Several cutting edge LNG bunkering projects are now underway across Europe, North America and Asia to bring much needed scale and capacity to this nascent infrastructure sector. In Rotterdam, the Gate terminal has begun operations in 2021 to provide ship-to-ship LNG bunkering using a dedicated bunker vessel. The terminal can supply over 20,000 m3 of LNG per week via truck-to-ship methods in addition to ship-to-ship operations. Another ambitious project is the LNG bunkering terminal under development in nearby Eemshaven port in the Netherlands. Set to be complete in 2024, it will feature a new jetty and storage tanks capable of supplying 5-10 truckloads of LNG per day via ship-to-ship bunkering.

In North America, Cargas marine terminals on the US Gulf Coast is constructing a multi-million dollar LNG bunker barge set to launch service in 2023. With a 4,000 m3 capacity, it will be able to refuel large container ships and other vessels operating between US Gulf ports. Canada’s Vancouver Fraser Port Authority is working on a shoreside LNG bunker terminal that will be the first of its kind in North America when it opens in late 2023. It will have dual truck loading and ship bunkering capabilities.

Major Asian ports are also making big investments to boost LNG bunkering capacity. Most notably, Singapore’s PSA Marine and Shell Eastern Petroleum have joined hands to build a $175 million LNG bunker terminal at Jurong Island port. Slated for completion in 2024, it will have a storage tank capacity of 10,000 m3 allowing refueling of very large container vessels with LNG volumes up to 2,200 m3 per shipment. South Korea is aggressively pursuing LNG as a marine fuel and has earmarked over $80 million for various LNG infrastructure projects across its ports in Busan, Ulsan and Incheon by 2025.

With pipeline connections and dedicated bunker vessels now central to the design of these new terminals, the emerging LNG bunkering landscape is transitioning towards providing ship operators with access to significantly higher volumes at lower prices compared to truck-based supplies. This holds potential to accelerate the rate of conversion to LNG across international shipping where cost competitiveness is key. However, integrating mid-stream infrastructure also introduces wider commercial and regulatory challenges that will need to be carefully addressed.

The Way Forward – Overcoming Challenges to Growth

Even with the unprecedented level of investment underway, there remain critical challenges that could potentially inhibit or slow the optimum growth of LNG bunkering infrastructure worldwide. Perhaps the biggest issues relate to creating a harmonized global regulatory framework for LNG bunkering operations as well as standardizing technical rules and best practices.

While individually ports and authorities have progressed in developing guidelines suited to their local needs, a lack of coherence across regions and countries continues to generate legal and commercial uncertainties for ship operators and bunker suppliers trying to offer cross-border services. Areas like crew training certification, documentation procedures, equipment specifications, and emergency preparedness protocols would benefit greatly from mutual recognition and compatibility on an international level.

Additionally, there are questions around the long term commercial viability of large LNG bunkering terminals currently under construction. Guaranteeing returns on multimillion dollar infrastructure investments will require predictable demand growth curves backed by firm commitments from shipowners and charterers over extended periods. But with LNG still being adopted incrementally in international shipping, volume risk remains a dampener for both investors and potential customers.

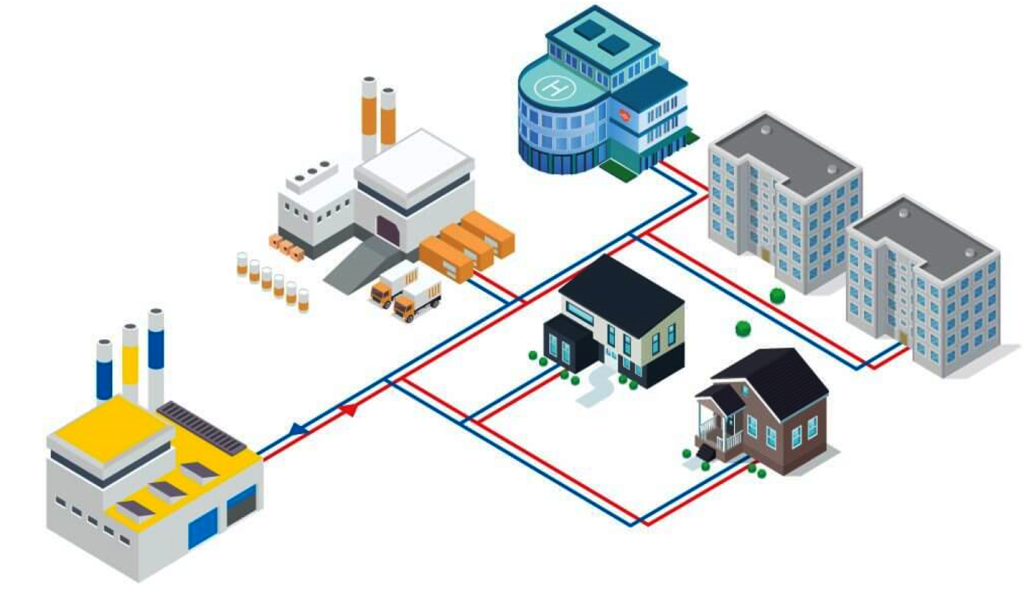

Careful coordination is also needed to optimize integration between emerging bunkering infrastructure and supply logistics such as LNG terminals, production sites, storage facilities and transport networks. Fully leveraging economies of scale will hinge on efficient interlinking of these various elements across often sprawling port zones and shipping lanes.

Going forward, continued engagement between regulators, classification societies, fuels producers and vessel operators will be vital in hammering out progressive solutions that minimize risks, reduce costs and strengthen commercial tenability for expanding the global LNG bunkering sector at the scale ultimately required. Standardization of concepts and best sharing of practical experiences between pioneering ports will also help sharpen strategies to sustain healthy long term growth of this critical maritime industry.