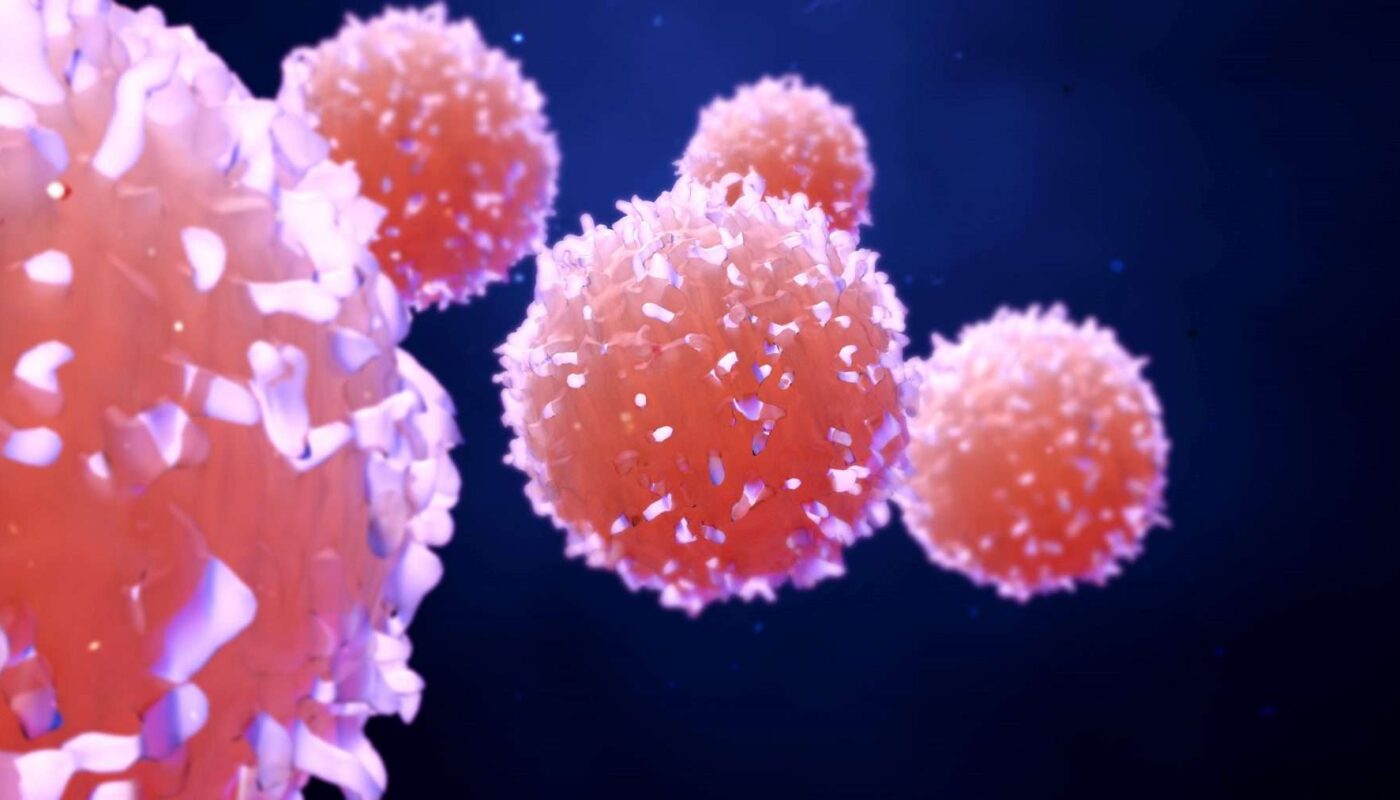

Adoptive cell therapy involves the genetic modification of T cells or other immune cells obtained from a patient to produce receptor molecules that will direct the immune cells to recognize and destroy cancer cells. Chimeric antigen receptor (CAR) therapy is one type of adoptive cell therapy that uses gene therapy techniques to genetically engineer T cells to recognize antigens or proteins on the surface of cancer cells or intracellular cancer-associated antigens. These engineered T cells are then infused back into patients to seek out and destroy cancer cells. Commonly targeted cancer antigens include CD19, CD20, and BCMA. The global adoptive cell therapy market is dominated by autologous CAR-T therapies Yescarta and Kymriah that are used for the treatment of certain blood cancers.

The global adoptive cell therapy Market is estimated to be valued at US$ 6903.93 Mn in 2024 and is expected to exhibit a CAGR of 4.8% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

Growing Applications in Cancer Treatment: As mentioned in the heading, growing research and development activities are focused on developing adoptive cell therapies for various cancers beyond blood cancers. Several CAR-T cell therapy candidates are in clinical trials for solid tumors like lung cancer, colorectal cancer, melanoma, and others which is expected to drive the market growth over the forecast period.

Increasing Research Funding: Numerous public and private organizations are funding research related to the development of new and more effective adoptive cell therapy products. For instance, the National Cancer Institute (NCI) funds extensive research in CAR T-cell therapy clinical trials through its Cancer Immunotherapy Trials Network. Such increased research funding is boosting the clinical research and development of new adoptive cell therapy products in the market.

Segment Analysis

The adoptive cell therapy market is segmented based on therapy type, application, end user and region. Based on therapy type, the market is segmented into tumor-infiltrating lymphocyte (TIL) therapy, engineered T cell receptor (TCR) therapy, chimeric antigen receptor (CAR) T cell therapy and natural killer (NK) cell therapy. Among these, CAR T cell therapy dominates the market and accounts for around 60% share due to high success rate in treating blood cancers.

PEST Analysis

Political: Regulatory bodies like FDA provide approvals and guidelines regarding use of adoptive cell therapy for various diseases. Stringent rules help ensure patient safety.

Economic: Rising healthcare spending globally especially in developing nations boosts market growth. High treatment cost is a restraint.

Social: Increasing cancer prevalence drives demand. Awareness about new therapies like CAR T cells raises adoption.

Technological: Research to develop new therapy types against varied cancer types and infections is ongoing. Use of AI and big data helps improve effectiveness. Cell engineering techniques are advancing to enhance safety and efficacy.

Key Takeaways

The Global Adoptive Cell Therapy Market Size is expected to witness high growth. The global adoptive cell therapy Market is estimated to be valued at US$ 6903.93 Mn in 2024 and is expected to exhibit a CAGR of 4.8% over the forecast period 2024 to 2031.

Regional analysis comprises North America holds the largest share currently due to technology leadership and presence of key players. Asia Pacific is expected to witness fastest growth due to rising healthcare investment, increasing cancer incidence and growing medical tourism.

Key players operating in the adoptive cell therapy market are Broadcom, Celeno Communications, Infineon Technologies, Espressif Systems Shanghai Co Ltd, GCT Semiconductor Inc., I&C Technology, Intel Corporation, MediaTek, Inc., and Microchip Technology Inc. Key players focus on new product development through R&D and strategic collaborations. For instance, Broadcom launched Wi-Fi 6E chipsets with advanced connectivity capabilities in 2022.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it